For example, a company that invests in technology or AI may find that they can streamline production to improve asset turnover. In contrast, a company that overinvests in underperforming assets will see how it adversely impacts the asset turnover ratio. It is extremely useful for the management, as it helps them ascertain the firm’s ability tax deadline is april 15, 2021 for 2020 taxes tax day 2021 to make use of its current resources in facilitating its turnover. A lower ratio implies that the sales generated are lower than they should be, considering the amount invested in the business by way of working capital. Hence, the management can take necessary steps in order to improve its sales and facilitate growth and development.

Understanding Working Capital

Also, it may not reflect the company’s performance accurately if the sales and working capital levels fluctuate significantly during the measurement period. Several factors impact how companies calculate and interpret their asset turnover ratio. By using this ratio, companies can evaluate their productivity in using assets that are on hand.

Articles

Grant Gullekson is a CPA with over a decade of experience working with small owner/operated corporations, entrepreneurs, and tradespeople. He specializes in transitioning traditional bookkeeping into an efficient online platform that makes preparing financial statements and filing tax returns a breeze. In his freetime, you’ll find Grant hiking and sailing in beautiful British Columbia.

Importance of Working Capital Turnover Ratio in Business

One common mistake businesses make when analyzing the working capital turnover ratio is getting stuck on the number alone. It is essential to look beyond the number at the underlying story and ask why the ratio is the way it is and what can be done to improve it. Additionally, businesses need to ensure that they make comparisons with companies in their industries, taking note of the differences in operations across various sectors. High – A high ratio is desired, it shows a high number of net sales for every unit of working capital employed in the business. However, a very high ratio is not desirable as it may signal that the company is operating on low working capital w.r.t revenue from operations.

- For example, if two of your close competitors have their WC turnover ratios of 3.2 and 3.8 and yours is 6, then yours would be deemed as high within your industry.

- In this article, we’ll take a closer look at the concept of working capital turnover ratio, how it’s calculated, its importance in business, and how it can be used for effective decision-making.

- Conversely, a low ratio could mean the exact opposite; hence understanding this ratio could help a business to identify potential inefficiencies in terms of working capital management.

- The working capital turnover ratio is expressed as a numerical value, and it can sometimes be converted to a percentage for easier comparison across different businesses or industries.

Current Assets

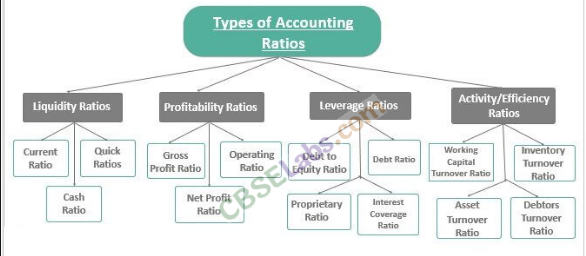

The working capital turnover ratio and inventory turnover ratio are two different but related metrics. In essence, it is an efficiency ratio that shows how well a company manages its inventory levels. As a key financial ratio, the working capital turnover ratio measures a company’s efficiency in managing its working capital (i.e., current assets and current liabilities).

In other words, for every rupee employed or used in the business, it is able to generate a higher amount of sales. However, a lower working capital ratio means that the amount employed in working capital is higher and that the turnover is not up to the mark. In other words, the turnover is lower than the minimum levels as per the given amount of working capital employed. The working capital turnover ratio is a financial metric that measures a company’s efficiency in using its working capital to generate revenue. This ratio is an important indicator of a company’s financial health and its ability to generate profits. A higher working capital turnover ratio indicates that a company is using its working capital more efficiently to generate revenue, which can lead to increased profitability.

It’s a commonly used measurement to gauge the short-term financial health and efficiency of an organization. The working capital turnover ratio is a valuable metric for evaluating a company’s financial health and its ability to generate profits. By analysing this ratio and taking steps to improve the efficiency of working capital, a company can increase its profitability, improve cash flow management, and achieve its growth objectives.

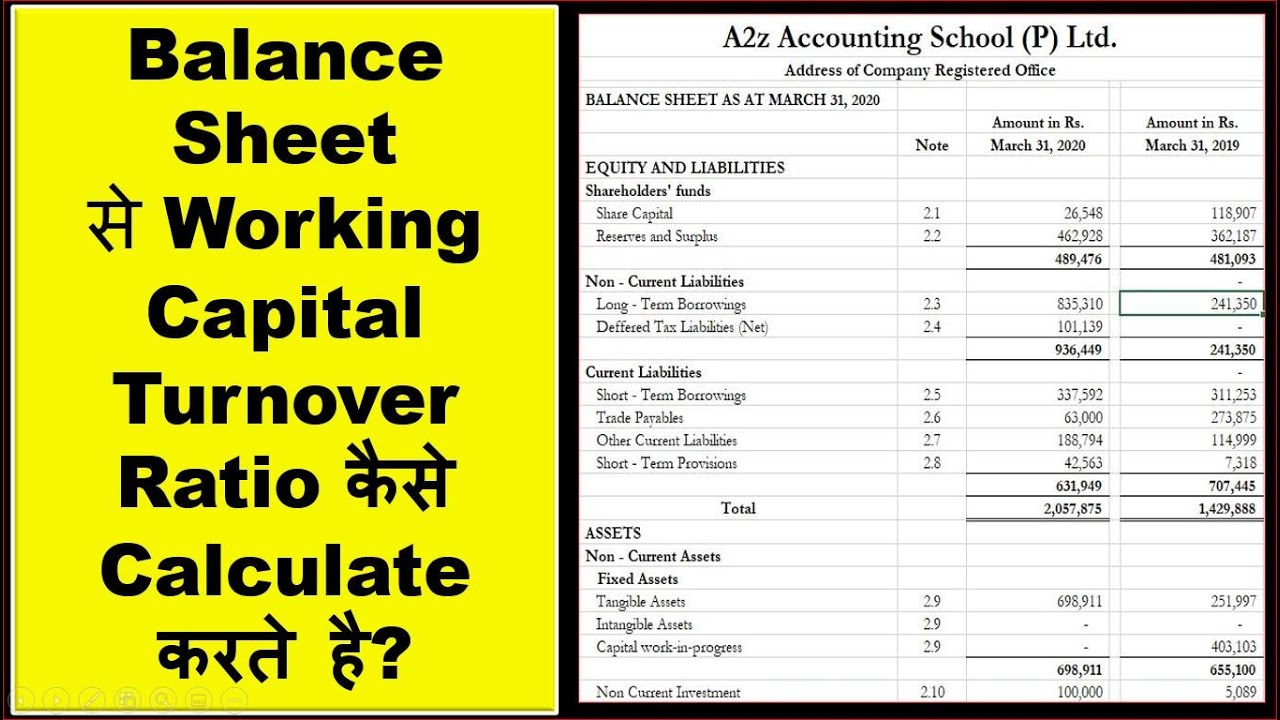

For your company’s steady finance, regularly keeping tabs on your working capital turnover ratio is highly suggested. First, calculate the working capital at the beginning and end of the year. As a reminder, to calculate your working capital, you simply subtract your current liabilities from your current assets. By having a greater understanding of your working capital turnover, you can make more informed decisions on where to invest and how to properly utilize resources.

The sales to working capital ratio is a liquidity measure that reflects how efficient a company is at generating sales revenue from its average working capital. To find your sales to working capital ratio, you can divide net annual sales by average working capital. Sales to working capital ratio and working capital turnover ratio can be used interchangeably. In conclusion, the working capital turnover ratio is a vital financial metric that can help companies assess their efficiency in using their working capital to generate revenue. By analysing this ratio, companies can identify areas for improvement, plan for future expenses and revenue growth, manage cash flow, and evaluate their performance.

Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. CAs, experts and businesses can get GST ready with Clear GST software & certification course.