Working capital turnover ratio establishes a relationship between the working capital and the turnover(sales) of a firm. In other words, this ratio measures the efficiency of a firm in utilising its working capital in order to support its annual turnover. A high working capital turnover ratio implies that the company is very efficient in using its current assets and liabilities to support its sales.

Working Capital Management

The working capital turnover ratio is a vital metric for managing business operations as it helps to ensure that a company is using its working capital efficiently to generate revenue. Working capital turnover ratio is an essential metric managers can use for financial decision-making. The ratio can provide insights into the financial health of a company and help evaluate the effectiveness of investments as well as pricing strategies. The ratio can also offer clues on how to better manage working capital and reduce the company’s operating costs. Furthermore, the working capital turnover ratio can also be used to assess the effectiveness of a company’s inventory management.

Enhance Accounts Payable Practices

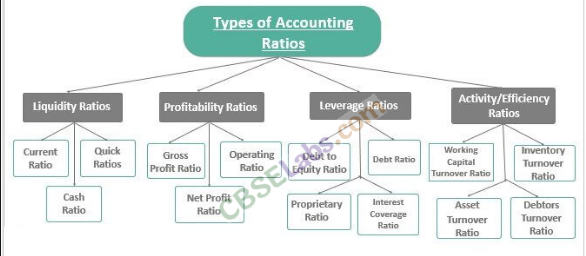

It is important to note that a high working capital turnover ratio may not always be a positive indicator. If a company has a very low level of working capital, it may struggle to meet its short-term obligations and may be forced to rely on external financing to cover its expenses. Additionally, a high working capital turnover ratio may indicate that a company is not investing enough in its current assets, which could limit its ability to grow and expand in the long run. Therefore, it is important to consider other financial ratios and metrics in conjunction with the working capital turnover ratio to gain a more comprehensive understanding of a company’s financial health. The working capital turnover ratio and the cash turnover ratio serve different purposes. The cash turnover ratio measures how efficiently a company generates sales from its cash on-hand, whereas the working capital turnover ratio considers all current assets and liabilities.

Why the Asset Turnover Ratio Calculation Is Important

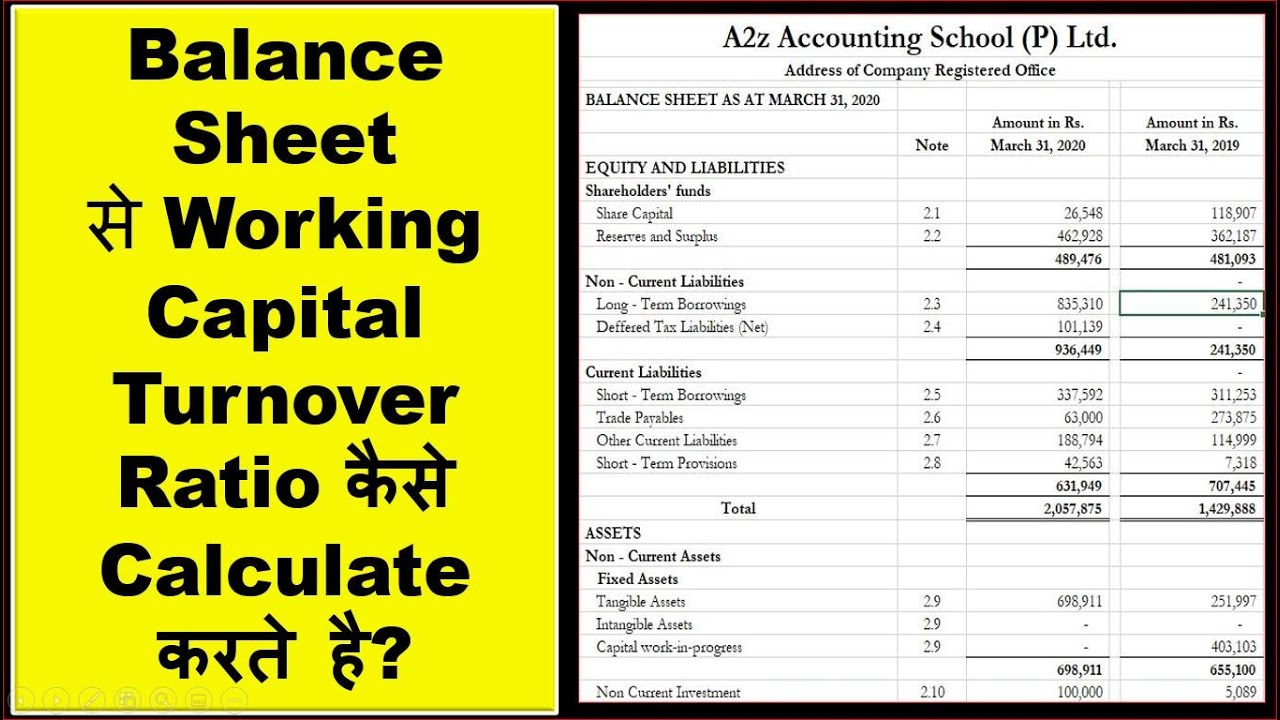

- Current assets are economic benefits that the company expects to receive within the next 12 months.

- GOBankingRates works with many financial advertisers to showcase their products and services to our audiences.

- When the current assets are higher than the current liabilities, the working capital will be a positive number.

- Determine your net annual sales by adding up your returns, allowances, and discounts.

Learning the working capital turnover ratio of your business can give you factual insights into its potential earnings. This significant measure shows how good your business is at changing capital into sales profit. In this piece, we’ll clear up what the working capital turnover ratio is, what it signifies, and present an example of how to calculate it using a formula. Companies can forecast future working capital by predicting sales, manufacturing, and operations.

Case Studies: Real-Life Examples of Businesses Using Working Capital Turnover Ratio Successfully

This ratio can be used to identify potential cash flow problems and take corrective action to improve cash flow management. The working capital turnover ratio is a financial ratio that measures the efficiency of a company in generating revenue from its working capital. Working capital is the difference between current assets and current liabilities and represents the funds available to a company to finance its day-to-day operations.

It tells you whether or not your leadership is good at managing cash flow within the organization. Look at how you’re pricing your goods or services and compare your pricing structure with industry norms and trends. The answer to your problem could be as simple as your product being too expensive. If that doesn’t work, revert back to your business budget, list of vendors, and sales ledger, and note where adjustments can be made to improve working capital. For example, according to this article on Medium.com, the retail industry has a benchmark of 5-10, while the construction industry has a benchmark of 2-4. Do research within your industry, especially your competitors, and compare your numbers against theirs.

Overall, the working capital turnover ratio is a measure of how efficiently a company is using its working capital to generate revenue. A higher ratio indicates that a company is generating more revenue for each dollar of working capital, which is generally seen as a positive sign for investors and stakeholders. In a practical scenario, net sales may not be provided, which can then be calculated on the basis of the cost of revenue from operations or cost of goods sold.

He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Let us try to understand how to calculate the working capital of an arbitrary company by assuming the variables used to calculate working capital turnover. The formula for calculating this ratio is by dividing the company’s sales by the company’s working capital.

When a company uses its working capital efficiently, it can generate more revenue with the same amount of investment, leading to higher profit margins. A low working capital turnover ratio may indicate that a company is carrying too much inventory, which can be a drain on cash flow. The working capital turnover ratio is one of many metrics you can use to assess the health of your tax relief services and consultations business. Let’s explore the advantages and disadvantages of using this accounting principle. Working capital turnover ratio establishes relationship between cost of sales and net working capital. As working capital has direct and close relationship with cost of goods sold, therefore, the ratio provides useful idea of how efficiently or actively working capital is being used.

A higher ratio is indicative of a business’s ability to efficiently use its working capital to drive sales, denoting good financial health. On the other hand, a low ratio could imply that a company is not using its working capital effectively, possibly due to excess inventory or simply lack of sales, which could lead to cash flow issues. The working capital turnover ratio is also closely related to cash flow management. By improving the efficiency of working capital, a company can free up cash for other activities, such as investing in new projects or paying off debt.