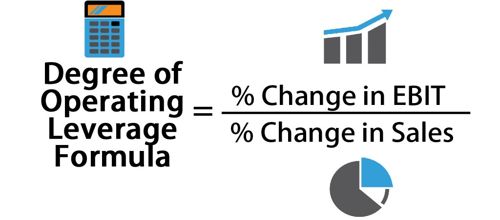

A firm with a relatively high level of combined leverage is seen as riskier than a firm with less combined leverage because high leverage means more fixed costs to the firm. The Degree of Operating Leverage (DOL) indicates how sensitive a company’s operating income is to changes in sales volume. The degree of operating leverage calculator is a tool that calculates a multiple that rates how much income can change as a consequence of a change in sales. In this article, we will learn more about what operating leverage is, its formula, and how to calculate the degree of operating leverage. Furthermore, from an investor’s point of view, we will discuss operating leverage vs. financial leverage and use a real example to analyze what the degree of operating leverage tells us. This ratio helps managers and investors alike to identify how a company’s cost structure will affect earnings.

Create a Free Account and Ask Any Financial Question

On the other hand, financial leverage is an indication of how much the company uses debt to finance its operations. Typically, companies that have a large proportion of fixed cost to variable attention required! cloudflare cost have higher levels of operating leverage. To elaborate, it measures how much a company’s operating income will change in response to a change that’s particular to sales.

What Are the Differences Between Operating Leverage and Financial Leverage?

Financial and operating leverage are two of the most critical leverages for a business. Besides, they are related because earnings from operations can be boosted by financing; meanwhile, debt will eventually be paid back by those increased earnings. Once obtained, the way to interpret it is by finding out how many times EBIT will be higher or lower as sales will increase or decrease respectively. For example, for an operating leverage factor equal to 5, it means that if sales increase by 10%, EBIT will increase by 50%. To determine whether your business has a high or a low DOL, examine your organisation’s performance compared to other organisations. However, you should not be referring to every industry as some might have higher fixed costs than other industries.

- We put this example on purpose because it shows us the worst and most confusing scenario for the operating leverage ratio.

- If the company’s sales increase by 10%, from $1,000 to $1,100, then its operating income will increase by 10%, from $100 to $110.

- The shared characteristic of low DOL industries is that spending is tied to demand, and there are more potential cost-cutting opportunities.

- In most cases, you will have the percentage change of sales and EBIT directly.

Evaluate Financial Risk

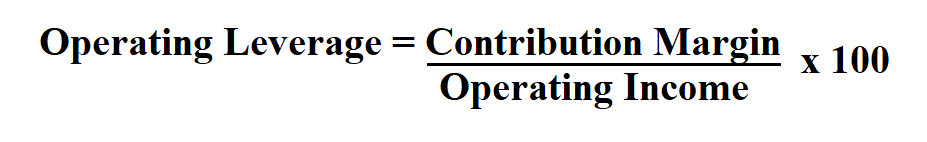

If the composition of a company’s cost structure is mostly fixed costs (FC) relative to variable costs (VC), the business model of the company is implied to possess a higher degree of operating leverage (DOL). Operating Leverage is a financial ratio that measures the lift or drag on earnings that are brought about by changes in volume, which impacts fixed costs. Many small businesses have this type of cost structure, and it is defined as the change in earnings for a given change in sales. Operating leverage is a cost-accounting formula (a financial ratio) that measures the degree to which a firm or project can increase operating income by increasing revenue. A business that generates sales with a high gross margin and low variable costs has high operating leverage.

The higher the DOL, the more a company’s operating income will be affected by changes in sales. If a company has low operating leverage (i.e., greater variable costs), each additional dollar of revenue can potentially generate less profit as costs increase in proportion to the increased revenue. The reason operating leverage is an essential metric to track is because the relationship between fixed and variable costs can significantly influence a company’s scalability and profitability. Here’s how you can use an Operating Leverage Calculator to understand how your company’s fixed and variable costs impact profitability. Consequently it also applies to decreases, e.g., a 15% decrease in sales would result to a 45% decrease in operating income.

Great! The Financial Professional Will Get Back To You Soon.

If fixed costs remain the same, a firm will have high operating leverage while operating at a higher capacity. By calculating the DOL, you can understand how fixed costs influence your business profitability. A higher DOL means that a small change in sales can have a significant impact on your operating income. The Excel degree of operating leverage calculator is available for download below.

It is important to compare operating leverage between companies in the same industry, as some industries have higher fixed costs than others. Scenario planning becomes more straightforward with the DOL calculator at your disposal. Assess different scenarios by adjusting sales volumes and costs to see how your operating income would be impacted. On the other hand, if the case toggle is flipped to the “Downside” selection, revenue declines by 10% each year, and we can see just how impactful the fixed cost structure can be on a company’s margins. Now, we are ready to calculate the contribution margin, which is the $250mm in total revenue minus the $25mm in variable costs.

In contrast, a computer consulting firm charges its clients hourly and doesn’t need expensive office space because its consultants work in clients’ offices. Other company costs are variable costs that are only incurred when sales occur. This includes labor to assemble products and the cost of raw materials used to make products.

If you’re eager to understand how changes in sales impact your operating income, you’re in the right place. This guide will walk you through the ins and outs of using the Degree of Operating Leverage Calculator, all while keeping things engaging and lighthearted. We put this example on purpose because it shows us the worst and most confusing scenario for the operating leverage ratio. The Degree of Operating Leverage is also important for an investor, as it can indicate the risk of an investment and illustrates the performance of a company. Read on to learn how to calculate DOL and how different it is from financial leverage. A company with high financial leverage is riskier because it can struggle to make interest payments if sales fall.