As an example, many nonfinancial corporate businesses have seen their D/E ratios rise in recent years because they’ve increased their debt considerably over the past decade. Over this period, their debt has increased from about $6.4 billion to $12.5 billion (2). Additional factors to take into consideration include a company’s access to capital and why they may want to use debt versus equity for financing, such as for tax incentives. When making comparisons between companies in the same industry, a high D/E ratio indicates a heavier reliance on debt. The D/E ratio represents the proportion of financing that came from creditors (debt) versus shareholders (equity).

Debt to Equity Ratio vs Financial Leverage

However, because the company only spent $50,000 of their own money, the return on investment will be 60% ($30,000 / $50,000 x 100%). If the company uses its own money to purchase the asset, which they then sell a year later after 30% appreciation, the company will have made $30,000 in profit (130% x $100,000 – $100,000). With high borrowing costs, however, a high debt to equity ratio will lead to decreased dividends, since a large portion of profits will go towards servicing the debt. This is because the company will still need to meet its debt payment obligations, which are higher than the amount of equity invested into the company. For this to happen, however, the cost of debt should be significantly less than the increase in earnings brought about by leverage.

Putting the D/E in Context

With financial leverage, the expectation is that the acquired asset will generate enough income or capital gain to offset the cost of borrowing. Debt to equity ratio also affects how much shareholders earn as part of profit. With low borrowing costs, a high debt to equity ratio can lead to increased dividends, since the company is generating more profits without any increase in shareholder investment. While this limits the amount of liability the company is exposed to, low debt to equity ratio can also limit the company’s growth and expansion, because the company is not leveraging its assets. A low debt to equity ratio, on the other hand, means that the company is highly dependent on shareholder investment to finance its growth.

Debt to Equity Ratio Formula (D/E)

For example, Nubank was backed by Berkshire Hathaway with a $650 million loan. A good D/E ratio also varies across industries since some companies require more debt to finance their operations than others. Assessing whether a D/E ratio is too high or low means viewing it in context, such as comparing to competitors, looking at industry averages, and analyzing cash flow.

Retention of Company Ownership

- Whether evaluating investment options or weighing business risks, the debt to equity ratio is an essential piece of the puzzle.

- This is because ideal debt to equity ratios will vary from one industry to another.

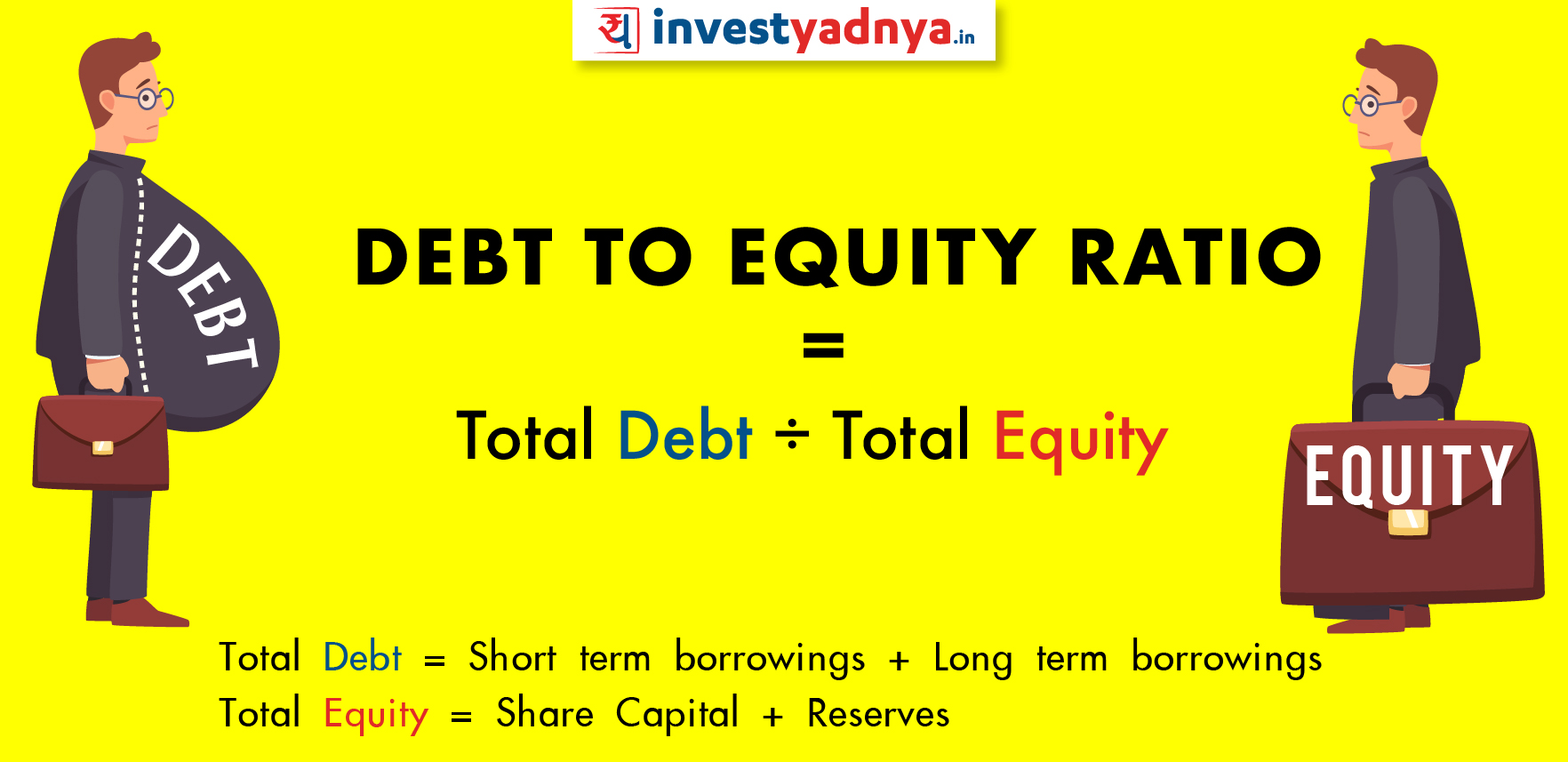

- It is calculated by dividing the total liabilities by the shareholder equity of the company.

Industries that are capital-intensive, such as utilities and manufacturing, often have higher average ratios due to the nature of their operations and the substantial amount of capital required. Therefore, it is essential to align the ratio with the industry averages and the company’s financial strategy. The debt-to-equity ratio is an essential tool for understanding a company’s financial stability and risk profile. By analyzing this ratio, stakeholders can make more informed decisions regarding investments and lending, ultimately contributing to better financial outcomes. Companies can improve their D/E ratio by using cash from their operations to pay their debts or sell non-essential assets to raise cash. They can also issue equity to raise capital and reduce their debt obligations.

How do companies improve their debt-to-equity ratio?

As a general rule of thumb, a good debt-to-equity ratio will equal about 1.0. However, the acceptable rate can vary by industry, and may depend on the overall economy. A higher difference between horizontal and vertical analysis with comparison chart debt-to-income ratio could be more risky in an economic downturn, for example, than during a boom. In fact, debt can enable the company to grow and generate additional income.

If a company has a negative D/E ratio, this means that it has negative shareholder equity. In most cases, this would be considered a sign of high risk and an incentive to seek bankruptcy protection. We can see below that for Q1 2024, ending Dec. 30, 2023, Apple had total liabilities of $279 billion and total shareholders’ equity of $74 billion.

A debt-to-equity ratio of between 1 and 1.5 is good for most businesses, but some industries are capital intensive and businesses in these industries traditionally take on more debt. This proves that the business has financed itself without needing to borrow. But it can also show investors that business owners aren’t realising their company’s full potential because they’re not borrowing to grow. Now We will calculate the Debt Equity Ratio using the debt to equity ratio formula. In contrast, companies looking to expand or diversify might again increase borrowing, potentially raising the ratio. Understanding where a company is in its lifecycle helps contextualize its debt ratio.

Whether evaluating investment options or weighing business risks, the debt to equity ratio is an essential piece of the puzzle. Understanding the debt to equity ratio is essential for anyone dealing with finances, whether you’re an investor, a financial analyst, or a business owner. It shines a light on a company’s financial structure, revealing the balance between debt and equity. It’s not just about numbers; it’s about understanding the story behind those numbers.